This month, the Australian Gov launched a new website to teach teens about money. Money Managed is stacked with resources and tools to get our kids on board with what money is and does. I think it’s bloody marvellous.

Many Mumlyfe readers will be aware that I have worked at SBS Food for over four years, but many of you won’t know that for the past year, I’ve also been the editor for Kochie’s personal finance website. Yes, I know what you’re thinking – whaaaat?!

I’m not exactly known as a maths whiz. In fact, I achieved (and here I use the word ‘achieved’ very lightly) a massive 10 per cent for maths in my HSC.

Yes, I hated maths, hated everything about it.

Which is why, when a friend asked me to come on board for a ‘month or so’ at Your Money & Your Life, I was quite sceptical. The editing and content massaging, I could do, no problem. The actual writing about big, audacious finance topics – ha! Jokes, right?

Finance just needs an interpreter

Anyway, turned out it wasn’t a joke and that I was actually a fantastic choice for the role (hence one month turned into many). Mostly because I am married to a finance guy (thank you, Bart, for your guidance through those rocky first months), and also because… I got interested. In fact, I became so curious about this foreign world of finance that I started reading everything I could get my hands on and then I read some more.

It turned out, the world of finance is actually just as scary as I always knew it to be, but it doesn’t have to be. Finance just needs a really good interpreter.

Which is what I do at Your Money & Your Life and what this new Money Managed site does, too. It’s an excellent reminder that finance really isn’t maths… something I think kids need to understand. Especially those who have a maths block, like I did.

In fact, one of Australia’s top mathematicians, Adam Spencer, told Money Mag that they’re not the same thing at all:

“Here’s a generalisation – people think if you’re good at maths, you’ll be awesome at money,” he says. “I don’t think those two things necessarily go together at all. I can calculate percentages and what you’ll need as a deposit and things like that, but in terms of natural sense with money, I don’t have much at all. My parents never sat down and talked money with me.”

So, take Adam’s advice and sit down and talk money with your kids.

Side note: he might not know about money, but boy does he get maths, buy Adam’s latest book here.

Three things for financial security

It doesn’t have to be a complicated discussion. There are just three things you need to do in order to be financially secure:

- Earn some money

- Spend less of that money than you earned

- Invest the difference.

See, not so scary, and yet… very scary, because you don’t know what you don’t know. I definitely never started investing early enough in my life. I had no idea that it was even a thing for mere mortals to do. Only rich people bought shares and investment properties and other things I didn’t understand.

If you do one thing today, introduce your kid to Money Managed. It’s a good way to teach teens about money because it will introduce them to the fundamentals they need.

I’ll tell you where there is a massive gap on the site, though. As far as I’m concerned, there should be a giant compound interest calculator parked on every single page.

The #1 thing to know

Compound interest is basically how people get wealthy. Mostly through buying some shares, reinvesting any returns and leaving their money alone for decades. Australia’s superannuation scheme basically lives and breathes through the power of compounding. Start tucking money away when you’re young so you’ve still got money when you’re old.

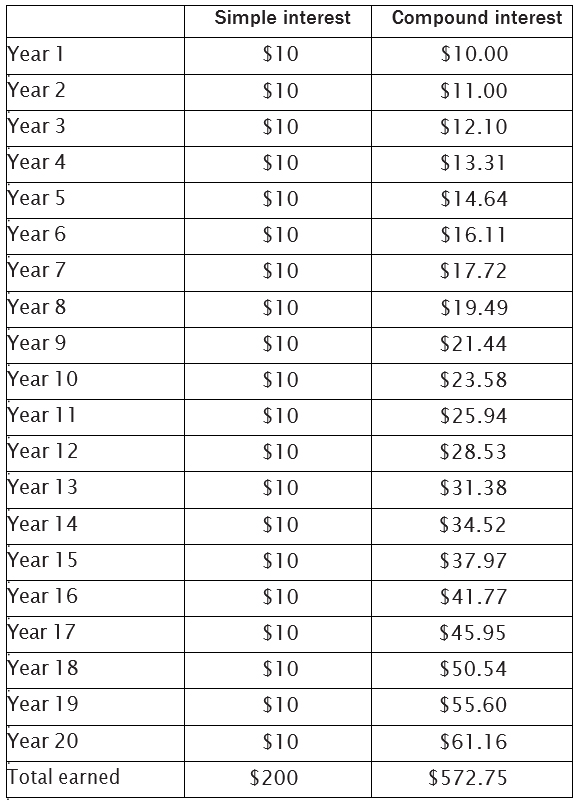

Here’s a simple vs compound interest breakdown (that’s much more interesting than your maths class):

The essential thing to note (and the reason we need to teach teens about money) is that time is a key variable in compounding. The longer you can leave your money there, the bigger it will grow. This is illustrated very well by the team at Equity Mates in their book ‘Get Started Investing‘.

If you invest just $100 and earn 10 per cent interest, with simple interest you get paid $10 every year. With compound interest the amount you get paid increases every year. Over time a big difference starts to emerge:

This is starting with a tiny $100 bucks and not adding anything else to the account. To find out what happens with bigger numbers, check out a compound interest calculator. For example, if you start with your $100, but commit to adding $10 a week, you’ll end up with $33,639 after the 20 year period at 5 per cent interest. Add $20 a week, and you’ll have $66,545. Keep going for another 10 years (30 years in total), and your tiny $20 a week will spit out $197,893.

It’s worth starting as early as possible, right?

Automate for success

While it can be hard to convince a teen to start putting away even $10 a week towards their elderly future (any age over 30 being ancient, of course), it can be done. Automation is your friend when it comes to all things teen – especially teaching them about money.

Help them set up a weekly direct debit from their account into an investment account. This should be on their regular pay or pocket money day.

Start young: 60+ ways for kids to make money outside of the home

Doing this is tapping into the basic ‘pay yourself first’ principle of budgeting. Take the money you want to save out of the equation before you really know you even have it.

But where can teens invest? They don’t have to lock their money away in super – there are other ways to invest that keeps their money accessible. Remember though, the longer you leave your money, the greater the compounding benefits.

We have an robo-investment account set up through Stockspot for each of our kids. You can direct deposit straight into the fund, and it invests your money each time your deposits reach $1k. Once they started working, our teens started contributing 10 per cent of their weekly pay into the same account.

More on this: 50+ jobs for teens that will benefit them for life

The investments are essentially held in our kids’ names via us until they each turn 18 years – then they will be transferred to them entirely. There are other investing platforms that will let you do the same thing, check out places like Raiz and Superhero.

It doesn’t really matter where your kids invest, just that they get into the habit of siphoning off part of their ‘income’ and they learn not to touch it.

Investing is different to saving

If your teen is saving towards something already – a car, holiday, uni, etc – you can still emphasise the importance of putting something into a long-term investment account. It’s all about teaching them the discipline to consider their long-term future self. Our kids put 10 per cent into their long-term investment and allocate another percentage to saving for other things.

The main thing is to start a conversation as soon as possible. If you’re not confident with finances yourself, perhaps the Money Managed website is a good place for you to start, too.

* This post is not sponsored by anyone. This article contains general information only. It should not be relied on as independent finance or tax advice. You should obtain specific, independent professional advice from a registered tax agent or financial adviser in relation to your particular circumstances.

Feature image by micheile || visual stories; spilled money by Josh Appel